![]()

Semiconductor Growth Fund, System Semiconductor Fund, Second Battery Growth Fund, Fintech Innovation Fund, etc.

![]()

Growth Ladder Fund, Materials, Parts and Equipment Innovation Fund, Growth Support Fund, New Deal Industry Scale-up Fund, etc

![]()

IBK Innovation Fund, POSCO New Growth Fund, Hyundai Motor Group Future Car Growth Fund, Hana-New Deal K-Growth Fund, etc.

![]()

Korea Startup Market Fund, KOSDAQ Scale-up Fund, Capital Market Scale-up Fund, etc.

![]()

K-Social Impact Fund, Job Creation Fund, etc.

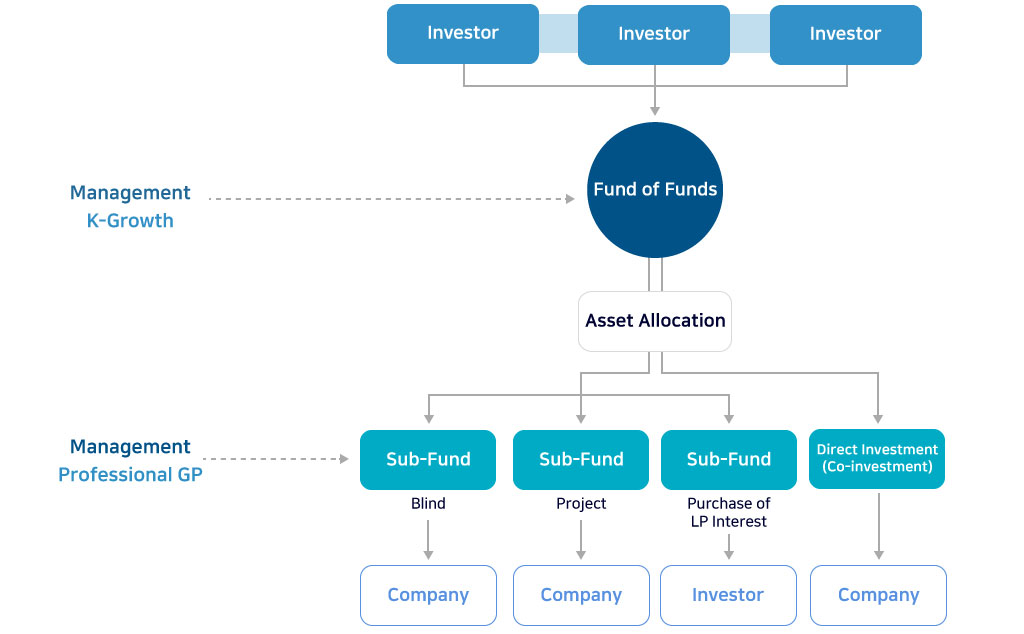

Blind Fund

This is a strategy for GPs to determine a sector of investment

and a size of fund and then invest in suitable companies

using the formed fund.

It is a representative investment strategy of FoFs

that can more flexibly respond to environmental changes

in the market in the future.

Project Fund

This is a strategy for GPs to decide the target companies to invest in

before launching the fund.

Through this strategy,

the GPs can select excellent investment opportunities

and improve profitability.

LP Interest Secondary

This is a strategy that a secondary buyer replaces an LP interest

in an existing fund and gains exposure in that fund.

Through this strategy, a secondary buyer can pursue high returns

by minimizing investment uncertainty

and shortening the payback period.

Direct Investment

This is a strategy to discover excellent investment opportunities

with high profitability based on various investment information

obtained from outstanding GP networks

secured through the FoFs business.

This is mainly carried out in the form of joint investment

with GP of the sub-fund,

and it enables business contact between the investment target

company

and the fund investors can be supported.

KDB Bank

KDB Bank

IBK Bank

IBK Bank

Korea Eximbank

Korea Eximbank

Hana Bank

Hana Bank

Shinhan Bank

Shinhan Bank

WOORI BANK

WOORI BANK

Kookmin Bank

Kookmin Bank

NongHyup Bank

NongHyup Bank

Busan Bank

Busan Bank

Daegu Bank

Daegu Bank

KyoungNam Bank

KyoungNam Bank

SAMSUNG

SAMSUNG

POSCO

POSCO

SK hynix

SK hynix

HYUNDAI

HYUNDAI

KIA

KIA

LG Energy Solution

LG Energy Solution

SK on

SK on

SAMSUNG SDI

SAMSUNG SDI

HYUNDAI MOBIS

HYUNDAI MOBIS

d·camp

d·camp

KAMCO

KAMCO

KOREA EXCHANGE

KOREA EXCHANGE

Korea Securities Finance Corp

Korea Securities Finance Corp

Korea Securities Depository

Korea Securities Depository

Korea Financial Investment Association

Korea Financial Investment Association

koscom

koscom

KIAT

KIAT

KB Foundation

KB Foundation

Naver financial

Naver financial

kakao pay

kakao pay

KIWOOM

KIWOOM

NH INVESTMENT & SECURITIES

NH INVESTMENT & SECURITIES

Hana Securities

Hana Securities

IBK Securities

IBK Securities

Yuanta Securities

Yuanta Securities

EUGENE INVESTMENT & SECURITIES

EUGENE INVESTMENT & SECURITIES

KOREA ASSET INVESTMENT SECURITIES

KOREA ASSET INVESTMENT SECURITIES

KB Securities

KB Securities

Hana Capital

Hana Capital

IBK Capital

IBK Capital

Shinhan Capital

Shinhan Capital

KDB Capital

KDB Capital

JB WOORI CAPITAL

JB WOORI CAPITAL

IBK Savings Bank

IBK Savings Bank

OK Savings Bank

OK Savings Bank

Hana Card

Hana Card

POSCO CAPITAL

POSCO CAPITAL

KB asset management

KB asset management

IBK Venture Investment

IBK Venture Investment

Hyundai Insurance

Hyundai Insurance